Credit rating, also to a lesser extent, earnings, commonly establishes acceptance for vehicle loans, regardless of whether by dealership funding or immediate lending. In addition, borrowers with superb credit history will probably receive lessen curiosity rates, that may end in shelling out much less for any car General.

Upstart can be a lending platform that connects borrowers who are searching for personalized loans with husband or wife banks and credit unions which can be prepared to finance.

Bankrate’s editorial crew writes on behalf of YOU – the reader. Our goal will be to provde the greatest tips that will help you make good particular finance selections. We follow demanding rules in order that our editorial articles isn't motivated by advertisers.

Paycheck progress applications let you borrow cash from your future paycheck. Normally, these apps don’t demand a credit history Check out and don’t charge fascination. Rather, some might demand a membership cost or ask for a voluntary idea.

So, you’re already getting a bad offer from the start. If you don’t repay your loan, the pawn shop will keep your collateral to offset its loss.

If only the regular monthly payment for just about any auto loan is provided, make use of the Regular monthly Payments tab (reverse vehicle loan) to estimate the particular motor vehicle obtain price as well as other vehicle loan information and facts.

It might be hard to know which a single is the best outside of all All those selections. This article will offer you a listing of seven Personal debt Aid so you may make an educated choice in advance of selecting what’s right for you.

Nearly all loan buildings include things like fascination, which can be the earnings that banks or lenders make on loans. Interest charge is The share of a loan paid by borrowers to lenders. For the majority of loans, fascination is paid In combination with principal repayment. Loan desire is normally expressed in APR, or once-a-year percentage level, which includes both of those curiosity and fees.

Receiving direct deposit. If the lender offers you the choice among direct deposit and paper Verify, direct deposit is faster.

An FHA cash-out refinance permits you to borrow towards the fairness in your house without needing to choose out a second home finance loan. An FHA cash-out refinance entails swapping out your existing house loan that has a new, much larger a person. If a FHA cash-out refinance isn’t perfect for your economical situation, a house fairness loan, HELOC or personalized loan might be a practical option.

Samples of these expenses involve consulting charges, fiscal Evaluation of prospective acquisitions, promotion expenses, and payments to employees, all of which has to be incurred prior to the organization is deemed active. In keeping with IRS suggestions, First startup expenditures have to be amortized.

Whilst CNBC Pick out earns a commission from affiliate companions on lots of offers and links, we develop all our content material without enter from our industrial workforce or any outside the house third get-togethers, and we delight ourselves on our journalistic benchmarks and ethics. See our methodology For more info on how we select the ideal unexpected emergency loans.

Covenants not to compete or non-contend agreements entered referring to acquisitions of website interests in trades or organizations

Who's this for? Prosper is well worth contemplating in the event you are searching for an alternative lender than a significant bank or credit score union.

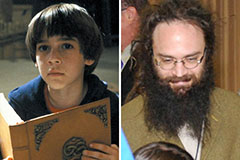

Barret Oliver Then & Now!

Barret Oliver Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Batista Then & Now!

Batista Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!